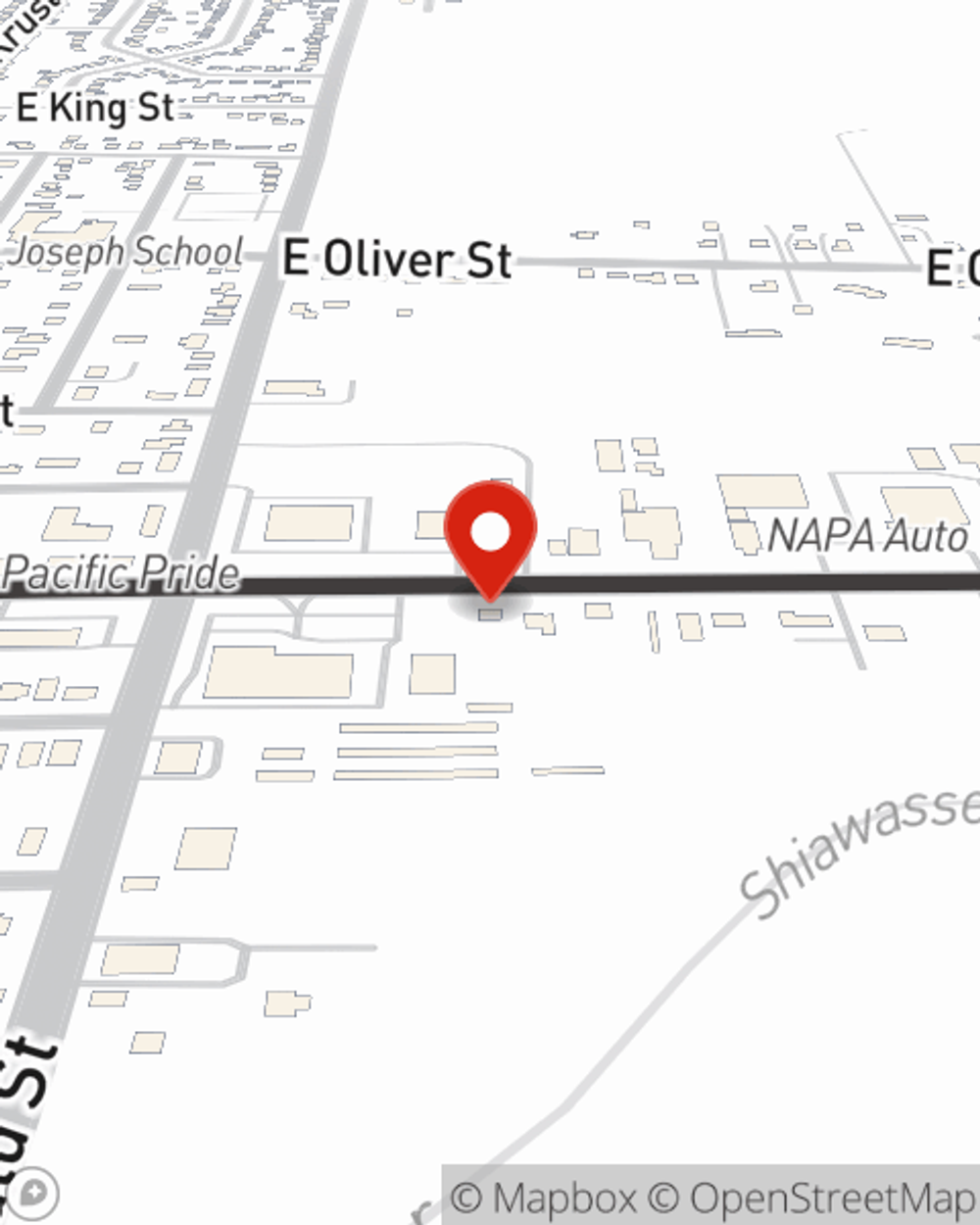

Business Insurance in and around Owosso

Looking for small business insurance coverage?

Almost 100 years of helping small businesses

State Farm Understands Small Businesses.

As a business owner, you have to manage all areas of business, all the time. The details can be overwhelming! You can maximize your efforts by working with State Farm agent Matt Grubb. Matt Grubb relates to where you are because all State Farm agents are business owners themselves. You'll get a business policy that covers your worries and frees you to focus on growing your business into the future.

Looking for small business insurance coverage?

Almost 100 years of helping small businesses

Cover Your Business Assets

That's because a small business policy from State Farm covers a wide range of concerns. Your coverage can include a business owners policy that provides for loss of income (for up to 12 months) in the event your business is closed down. It not only protects your take-home pay, but also helps with regular payroll costs. You can also include liability, which is important coverage protecting your company in the event of a claim or judgment against you by a customer.

When you get a policy through one of the leading providers of small business insurance, your small business will thank you. Contact State Farm agent Matt Grubb's team today to explore the options that may be right for you.

Simple Insights®

Disaster preparedness for your business

Disaster preparedness for your business

Create a business disaster plan to protect your employees, secure assets and resume operations.

Consider a Simplified Employee Pension plan for your small business

Consider a Simplified Employee Pension plan for your small business

Simplified Employee Pension IRA (SEP IRA) plans are employee IRAs funded by tax-deductible contributions from small business employers.

Matt Grubb

State Farm® Insurance AgentSimple Insights®

Disaster preparedness for your business

Disaster preparedness for your business

Create a business disaster plan to protect your employees, secure assets and resume operations.

Consider a Simplified Employee Pension plan for your small business

Consider a Simplified Employee Pension plan for your small business

Simplified Employee Pension IRA (SEP IRA) plans are employee IRAs funded by tax-deductible contributions from small business employers.